Tax system to be introduced in GB

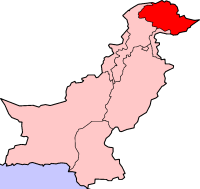

ISLAMABAD: A taxation system would be introduced in Gilgit-Baltistan on subjects falling under the jurisdiction of the GB Council.

The decision was taken at a meeting between Federal Minister for Kashmir Affairs and Gilgit-Baltistan and the Gilgit-Baltistan Council here on Friday.The meeting discussed introduction of the taxation system. However, tax rates would be discussed later in the month.

It was decided that the tax rate in the region would be half of that in the rest of the country.

Further the limit for minimum taxable income would be higher for Gilgit-Baltistan.

Chairing the meeting, Federal Minister Mian Manzoor Ahmad Wattoo said that Gilgit-Baltistan Council and the government are working according to the mandate of Gilgit-Baltistan Self Governance and Empowerment Order 2009.

He said that hydel power, mineral resources, forests and tourism are subjects of GB council which is responsible for legislation on these subjects and for the development of these sectors.

“We need to develop these resources locally through concrete measures,” the minister said.

“Besides increasing bilateral trade with China and development of industrial zone in Gilgit-Baltistan is also essential for the region.”

The meeting was attended by Governor GB Pir Karam Ali Shah, Chief Minister Syed Mehdi Shah, GB Minister of Law, Engineer Usman Khan, Secretary Kashmir Affairs and GB and Chief Secretary GB and other members of GB Council.

The meeting noted that progress and development planning have to be within the framework of Gilgit-Baltistan Self Governance & Empowerment Order 2009, which is drafted with the consensus of all stake-holders and is approved by the Parliament of Pakistan. The federal minister agreed to the proposal that the session of GB council to be held up to 50 days a year and the process of legislation be made more effective.

Next meeting in this connection would be held on Sept 30 in which a final decision would be taken on these proposals. DAWN

Related articles

- Gilgit-Baltistan: Gauging self-governance package’s efficacy, two years on (pamirtimes.net)

- [Opinion] An ugly state of affairs in Gilgit-Baltistan (pamirtimes.net)

Need in_ depth study, hard discussion,build consensus then go for implementation.

Imposing tax on people of GB is illegal according to international law “no taxation without representation” despite the fact people of the region are giving all indirect taxes and custom duties (in sost dry port). government is imposing income tax and all other taxes in the region against the so-called GB empowerment ordinance. FATA and certain areas of KPK are exempted from the tax despite of being in the main stream politics of the country. now question arises why only GB?? if GOV want to impose taxation it has to give all basic rights to people of GB other wise this act will b annul and people of GB will protest against it..

Paying tax is a must for development. However, its’ imposition without representation would be a stupid action. If the GB Govt. is represented by none sense, pseudo and titular rulers then they can go to any extent to please their masters in Islamabad.